More Notes About the Milberg Weiss Indictment and the Declining Number of Securities Lawsuits

The downturn is even more dramatic when the comparison of filing rates is taken further back in time. According to data graciously supplied to The D & O Diary by Bill Ballowe of Woodruff-Sawyer, the Milberg firm filed 124 lawsuits during the 16-month period from May 1, 2004 to August 31, 2005 (or an average of about 7.8 lawsuits a month), compared with only 37 new lawsuits during the period September 1, 2005 to June 30, 2006 (an average of about 3.7 lawsuits per month). The case filing data in the Reuters article suggests that this filing rate has declined as 2006 has progressed.

Nor is this dramatic downturn after September 2005 limited just to the Milberg Weiss law firm. Milberg Weiss’s alienated sibling firm, Lerach Coughlin, has also shown a similar decline in its rate of new case filings. According to Ballowe’s data, during the 16-month period from May 1, 2004 to August 31, 2005, the Lerach firm filed 179 new lawsuits (or about 11.2 per month) but during the ten-month period between September 1, 2005 and June 30, 2006, the Lerach firm filed only 52 new lawsuits (or only about 5.2 per month). There is some overlap in the filings as in many instances both firms initiated lawsuits against the same company.

This large drop off from these two major plaintiffs’ law firms is significant because, according to Ballowe’s data, only about a fifth of the time before September 1, 2005 and only about a quarter of the time after September 1, 2005, is a company sued in a securities class action lawsuit without one or the other of these two firms filing a complaint.

As The D & O Diary noted in its prior post, the drop off after mid-2005 is significant, because the indictment alleges that the practice of paying plaintiffs to permit plaintiffs’ attorneys to use their names to file lawsuits continued through 2005. Moreover, in June 2005, the U.S. Attorney's office in Los Angeles indicted Seymour Lazar for alleged accepting millions of dollars in kickbacks from the Milberg Weiss firm. Lazar is one of the Paid Plaintiffs identified in the Milberg Weiss indictment. The Lazar indictment, discussed in this July 19, 2005 International Herald Tribune article, undoubtedly had its impact on plaintiffs' firms and their practices. The indictment is clearly having an impact on the Milberg Weiss firm, and it hardly required a leap of imagination to suggest that the indictment is having its impact on the Lerach Coughlin firm as well. A prior D & O Diary post discussing the indictment’s possible impact on the Lerach Coughlin firm can be found here.

But regardless of its cause, the diminution in filing activities from the two leading firms has had a dramatic impact on overall securities litigation frequency.

Special thanks to Bill Ballowe for the securities class action filing data.

Anatomy of a Paid Plaintiff: One of the Paid Plaintiffs identified by name in the Milberg Weiss indictment is Stephen G. Cooperman. According to the indictment, during the relevant time, Cooperman resided in Brentwood, California and Connecticut and prior to May 1989 was a licensed ophthalmologist. According to the indictment, Cooperman and two relatives (identified as Cooperman Plaintiff 1 and Cooperman Plaintiff 2) received “approximately $6.5 million in secret and illegal kickbacks.” A copy of the First Superseding Indictment against the Milberg Weiss firm may be found here.

Readers with a longer memory may recall Cooperman’s involvement in an even more colorful set of circumstances that wound up having a critical impact on the Milberg Weiss criminal investigation. According to AP news reports, in June 1997, the Cleveland Police found two paintings that had been reported stolen from the Brentwood, California home of a Stephen G. Cooperman. According to the report and a related article in the Los Angeles Times, in 1991 Cooperman acquired $12.5 million in insurance for the two paintings. In 1992, Cooperman reportedly told police that someone burglarized his Brentwood home and stole the paintings while he was on vacation in New Jersey. Police found that Cooperman’s burglar alarm had not been tripped and there were no signs of a break in. The only things taken were the two paintings. According to the press reports, the two insurance companies sued Cooperman for fraud and settled out of court. The paintings later surfaced as a result of a domestic dispute, when a Cleveland woman told police that her ex-boyfriend had paintings in a climate-controlled rented locker. The lawyer, named in the reports as James Little, had done legal work for Cooperman while in Santa Monica in the early 1990s, before Little moved to Cleveland.

The news reports about the paintings may be found here. (Scroll through the listings to the entry for June 6, 1997).

Cooperman was later prosecuted and convicted of fraud charges in 1999 and faced a 10-year prison term. According to this New York Times article, to reduce his sentence, Cooperman offered to testify against Milberg Weiss. Cooperman was not sentenced until 2001, when his sentence was reduced and he ended up serving less than two years in prison. According to the Times article, the opinion in Cooperman's divorce case reports that Cooperman cooperated with prosecutors to help "implicate members of the Milberg Weiss firm."

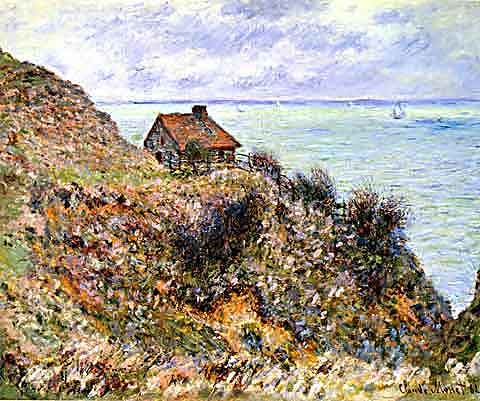

As part of its settlement with Cooperman, the insurance companies acquired title to the paintings. One of the paintings, entitled “The Custom Officer’s Cabin at Pourville” was painted by Claude Monet in 1882, and was one of 14 paintings that Monet did of an abandoned Napoleonic-era coast guard post overlooking the English Channel.

Monet had moved to Pourville after his first wife’s death from tuberculosis in 1879. The cycle of coast guard hut paintings prefigured later "series" paintings for which Monet is perhaps best known, reflecting a single subject in varying light and viewpoints. During the 1880s and 1890s, Monet painted over twenty views of the Rouen Cathedral, and later he painted a variety of perspectives on the water lilies in his garden at Giverny. Cooperman acquired the Monet from the Montgomery Gallery in San Francisco in 1987.

The second painting was entitled “Nude Before a Mirror” and had been painted in 1932 by Pablo Picasso. The painting’s more realistic style and more somber mood reflects the period between the wars when Picasso reverted to more of a classical technique, a phase he broke from in dramatic fashion in 1937 with his painting depicting the Guernica bombings. Cooperman also acquired the Picasso from the Montgomery Gallery.

Special thanks to a loyal D & O Diary reader for the Cooperman links.

1 Comments:

Res ipsa loquitur.

Post a Comment

<< Home