Regulatory Reform: Solving a Problem or Introducing a Weakness?

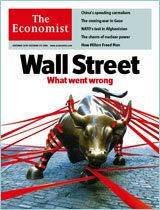

The Committee on Capital Markets Regulation (or the "Paulson Committee" as the group has come to be known) is scheduled to release its recommendations later this week, on November 30. The Paulson Committee is concerned with the competitiveness of the U.S. securities exchanges in the global marketplace, and the perceived inability of the U.S exchanges to compete due to the heavier regulatory and litigation burden in the U.S. Anticipation is building as the release date approaches; The Economist magazine's cover this week (reproduced above) depicts the iconic Wall Street bull entangled in red tape and asks the question "Wall Street: What Went Wrong?" A prior D & O Diary post examining some of the potential litigation reforms may be found here.

The Committee on Capital Markets Regulation (or the "Paulson Committee" as the group has come to be known) is scheduled to release its recommendations later this week, on November 30. The Paulson Committee is concerned with the competitiveness of the U.S. securities exchanges in the global marketplace, and the perceived inability of the U.S exchanges to compete due to the heavier regulatory and litigation burden in the U.S. Anticipation is building as the release date approaches; The Economist magazine's cover this week (reproduced above) depicts the iconic Wall Street bull entangled in red tape and asks the question "Wall Street: What Went Wrong?" A prior D & O Diary post examining some of the potential litigation reforms may be found here.But while we are awaiting the Committee’s actual recommendations, it is still timely to ask whether the regulatory burdens really are causing the non-U.S. companies to list their shares on other exchanges or if perhaps something else may be going on.

A speech earlier this fall by Public Company Accounting Oversight Board (PCAOB) board member Charles Niemeyer entitled "American Competitiveness in International Capital Markets" (here), provides a critical challenge to many of the presumptions behind the regulatory reform efforts.

First, with respect to the notion that the regulatory burdens of the Sarbanes-Oxley Act caused a recent decline in the number of non-U.S. companies listing their shares on U.S. exchanges, Niemeyer shows that the decline of the U.S. share of IPOs listed throughout the world began declining long before Sarbanes Oxley; the U.S. share of IPOs declined dramatically between 1996 and 2001 (from about 60 percent of all IPOs to less than 6 percent), but between 2001 and 2005 – that is, the period after Sarbanes-Oxley’s enactment – the U.S. share increased somewhat (to about 15 percent in 2005). Sarbanes-Oxley clearly is not the explanation for the reduced U.S. IPO marketshare.

Niemeyer asserts that the decline in U.S. share of the global IPO marketplace may be due to a number of causes, the most significant of which may simply be the availability of capital in local markets due to the universally low level of interest rates. Niemeyer also notes that "several countries are in the midst of multi-year programs to privatize state-owned businesses." For example, five of the largest 2005 IPOs (by market capitalization) were privatizations of state owned entities in China and France. As Niemeyer notes, "there are considerable political, cultural, and other influences on such companies to list locally when their markets offer sufficient liquidity." The low interest rate levels and high level of capital availability means that shares of this type tend to be listed locally -- and many of these companies are quite large which explains the larger aggregate capitalization of IPOs outside the U.S.

Niemeyer also notes that foreign companies are often dominated by narrow "control groups" that, in countries with poor investor protections, "tend to have valuable private benefits derived from control, because they are able to extract benefits from the company unchecked by minority shareholder rights." Niemeyer notes that these control groups are loathe to submit to the types of investor protections provided by a listing of shares in the U.S. markets. So there may be many foreign companies that would not under any circumstances choose to list on U.S. exchanges either because of their nationalistic affiliation of because of their managers' self-interested aversion to U.S. shareholder rights.

Niemeyer also points out that a substantial part of the drop in the U.S. share of worldwide IPOs is due to a dramatic decrease in the number of IPOs by U.S. companies, from about 375 in 2000 to less than 100 in 2001. Even more important for purposes of assessing the competitiveness of U.S. exchanges, "there was no commensurate shift by U.S. based companies to markets in other countries." While a great deal has been made about the competitiveness of the London Stock Exchange’s Alternative Investment Market, Niemeyer points out that as of March 2006, only 29 of the AIM’s 2,200 companies were based in the U.S., and seven of those 29 have dual listings or otherwise trade their shares on a U.S. exchange. Niemeyer questions whether the remaining 22 companies would even have qualified to list on U.S. exchanges, given AIM’s lower thresholds for offering size and other lower offering prerequisites.

The question whether we should care that even some companies are resorting to AIM was underscored in the Wall Street Journal’s November 21, 2006 article entitled "For LSE, A Troubling Trend" (here, subscription required), which reported that "a number of companies [on AIM] have issued profit warnings lately." The article goes on to quote an AIM spokesman that "the profit warnings have more to do with the smaller size of companies, where you have greater economic risk." Another LSE official is reported to have conceded that some companies allowed to list on AIM, in hindsight, shouldn’t have. In other words, AIM’s low barriers (smaller size, earlier offering) to entry may be attracting some less qualified companies – companies that simply couldn’t list on U.S. exchanges. The article also reports that the AIM benchmark index is down 1.8% this year, compared with London’s benchmark FTSE 100 index, which is up about 10%.

Can the case be made that perhaps the U.S. exchanges are better off without the companies that can satisfy the lower regulatory burdens in other countries but not the U.S.? A November 25, 2006 Wall Street Journal article by Herb Greenberg entitled "Is IPO Slowdown a Bad Thing, As Sarbanes-Oxley Foes Claim?" (here, subscription required) poses the question: "Has anybody stopped, just for a moment, to ask whether fewer IPOs might actually be a good thing? Seriously, maybe some of these companies shouldn’t go public in the first place, especially if they fear or don’t want to pay for laws that are attempting to crack down on skullduggery." Greenberg points out that "going public is a privilege and companies going through the process should welcome scrutiny and encourage proper barriers to entry."

Whether or not the U.S. exchanges are better off without some of the companies that are driven away by high regulatory barriers, it is unquestionably true that the high regulatory barriers produce benefits for the companies that meet the requirements. According to Niemeyer, companies that list their shares on U.S. exchanges receive a premium on their valuations. Niemeyer shows that non-U.S. companies that cross list in the U.S. enjoy a significantly lower cost of capital – in fact, the lowest in the world. This reduction in the cost of capital translates into a valuation premium that can reach as high as 37 percent more than their valuations would have been in their home markets. As Greenberg points out in his article, it is not as if the U.S. IPO business has withered and gone away. According to Greenberg, as of November 22, 2006, 172 companies had conducted offering on U.S. exchanges during 2006, raising a combined $38.8 billion. That compares with 213 offerings in all of 2005, raising a total of $38.5 billion. Hardly a slowdown, as Greenberg notes. {See the Update at the end of this post for additional information regarding the vaulation premium}

When the Paulson Committee releases its recommendations later this week, it will be worth asking with respect to the proposed reforms whether there really is a problem that needs to be remedied. As Niemeyer points out, one of the most important aspects of Sarbanes-Oxley is that it "reduces the risk of future catastrophic financial reporting failures." As the companies caught up in the current options backdating are finding now to their everlasting regret with respect to financial reporting, the "costs of getting it wrong still exceed the costs of getting it right."

Finally, while the reformers may be militating in favor of lowering U.S. regulatory burdens, other countries may be moving in the opposite direction. A November 23, 2006 Dow Jones Newswire article entitled "Insurers See Risk From U.S.-Style Lawsuits in Europe" (here) discusses concerns regarding the spread of U.S lawyers and the possible consequent spread of U.S. litigation to Europe and elsewhere. The article quotes European insurers for the view that "there are significant signs that the number of lawsuits is rising" outside the U.S. The article specifically cites the increase of class action litigation in Norway, Germany, Sweden and the U.K.

Hat tip to Jack Ciesielski at the AAO Weblog (here) for the link to the Niemeyer speech. Ciesielski also has an interesting commentary on the Greenberg article here. An interesting contrarian perspective on Greenberg's article may be found on Professor Larry Ribstein's Ideoblog, here.

The Economist Magazine's Perspective on Regulatory Reform: The article in The Economist magazine's issue with the red tape bound bull on the cover (reproduced above), entitled "Down on the Street," (here, subscription required) takes a characteristically balanced approach to the topic of regulatory reform. The article notes that many publicly listed companies are fleeing the glare of the public marketplace by going private; the article states "more of corporate America was taken out of public ownership by private-equity firms (spending $178 billion) in the first ten months of this year than in the previous five years combined ." The D & O Diary thinks this argument is a red herring; the boom of private equity acquisitions can only be understood as a direct outgrowth of the astonishing availability of private equity funding to invest. Corporate managers may welcome the chance to avoid the headaches of being a public company, but if there were not huge pots of money involved, the companies would remain public. The article is perhaps closer to the mark when it recalls that overly tight restrictions in the 1960s may have driven lenders and borrowers to London , leading to the creation of the Eurobond market, which now accounts for the largest share of publicly traded debt. The financial centers, New York, in particular will want to avoid ceding additional advantages.

The Economist may be closest to the mark when it recounts the quip from one unnamed Washington source that referred to the Paulson Committee as the "7% committee," referring to Wall Street's typical IPO underwriting fee, double that charged by European underwriters. The unstated suggestion is that the Committee's real goal is preserving Wall Street's oversized fees, which a neutral party assumes would be the first place that objective parties interested in advancing the competitiveness of America's securities markets would turn, rather than attempting to reduce regulatory protections.

The D & O Diary thinks investors' interests might be best served if we tried cutting underwriters' fees first, before cutting investors' protections, and see if that helps make U.S securities markets more attractive to foreign companies. That might also help preserve all the advantages that higher regulatory standards produce.

And Finally: In an earlier D & O Diary post, which may be found here, I reviewed the op-ed piece written by the head of an Indian company, in which the official explained his reasons why he proudly listed his shares on a U.S. exchange, notwithstanding the higher regulatory burdens. He felt that for his company the benefits far outweighed the burden.

Update: A November 28, 2006 Wall Street Journal article entitled "Is a U.S. Listing Worth the Effort?" (here, subscription required) reports on a recent study that will "figure prominently in a report to be released" by the Paulson Committee, and that reportedly concludes that "investors have sharply reduced the premium they pay for shares of foreign companies since a regulatory crackdown on corporate malfeasance in 2002." The newspaper article's lead would seem to suggest that this new study supports the Paulson Committee's underlying premise -- that is, that the new regulation has eliminated the valuation premium (discussed above) and therefore the Sarbanes Oxley related regulation is making the U.S. less competitive. However, the article discloses that in fact the premium has increased for companies from certain countries that have less rigorous local regulation (Italy, Austria and Turkey are specifically named), and that the decrease in the valuation premium has only taken place for companies from countries that have their own rigorous regulatory programs (Japan, Hong Kong, Canada and the United Kingdom). And for that matter, even in those countries with a decline, the decline is from 51 percentage points during the period 1997 to 2001, to 31 percentage points between 2002 and 2005.

While the study's sponsors interpret these data to mean that increased regulation is decreasing the valuation premium and therefore making the U.S less competitive, I have a hard time getting to that conclusion from this information. I think the fact that the premium has increased in countries with less rigorous local regulation means that the U.S regulatory approach is even more highly valued than before. Even if there is a decrease in the valuation premium for companies from more rigorously regulated, there is still a very significant valuation premium, and the decrease could be understood in any one of a number of ways, including the possibility that increased regulatory effectiveness in the other countries have started to reduce the value that is placed on the benefits of the U.S. scheme. The willingness of the London market to accept listings for companies that would not meet U.S standards is probably also a factor. Given the increase in the valution premium for companies from less rigorously regulated countries, and the still substantial valuation premium even for companies from more highly regulated countries, it is hard for me to see how decreasing regulation would improve U. S. competitiveness. It is entirely possible that what a lax regulatory scheme would accomplish is reducing the valuation premium (and the attractiveness of U.S. markets) for companies from the economies that will be growing most quickly in upcoming years.

0 Comments:

Post a Comment

<< Home